Renters Insurance in and around Garland

Garland renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is good to have, even if your landlord doesn’t require it.

Garland renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a condo or home, you still own plenty of property and personal items—such as a a piece of family jewelry, microwave, coffee maker, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from RaNae Candia? You need an agent with a true desire to help you examine your needs and understand your coverage options. With wisdom and efficiency, RaNae Candia is committed to helping you keep your things safe.

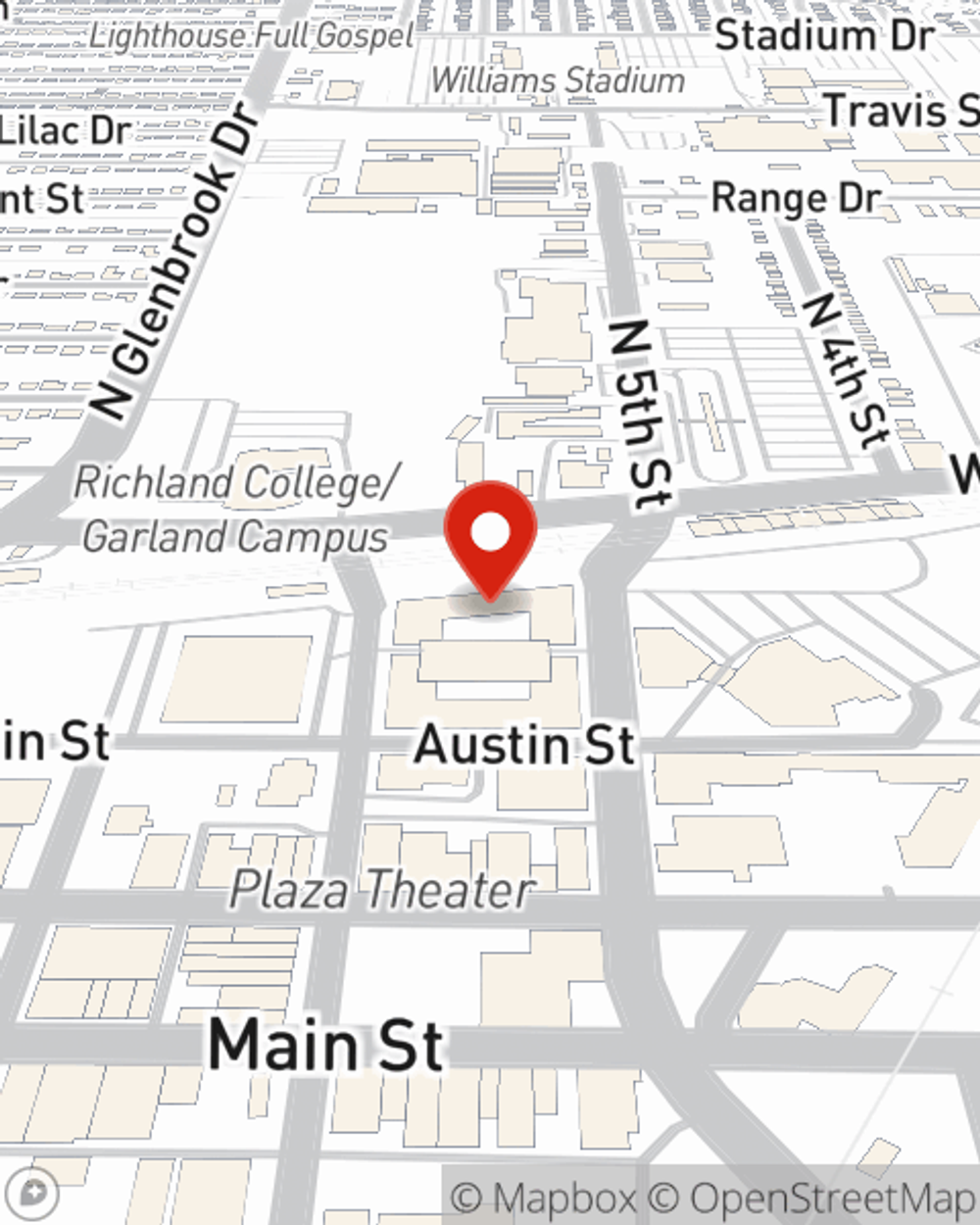

Renters of Garland, visit RaNae Candia's office to find out more about your particular options and how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call RaNae at (972) 276-1116 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

RaNae Candia

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.